May 19, 2020

Eitan Milstein

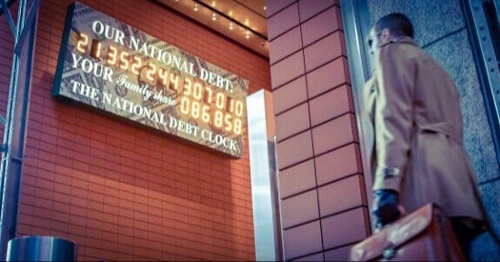

Congress and the Federal Reserve have already pumped trillions of dollars into the economy to limit the Coronavirus’s economic damage. Additional stimulus is likely. However, once the immediate crisis has passed, elected officials will face a debt reckoning. Their response could significantly alter how private businesses are valued, and how the owners of those companies asses their M&A opportunities.

In late April 2020, the Congressional Budget Office projected a nearly $4 trillion annual deficit. Despite inconsistent rhetoric from Washington regarding the ballooning national debt, lawmakers and the White House will ultimately be compelled to bridge the enormous gap between revenues and spending.

Increased taxation is the likely first step.

Code changes may include:

-

Corporate tax rate increases (currently 21%)

-

Eliminating NOL carryback provisions (a key part of Coronavirus stimulus package)

-

Less generous depreciation schedules

-

Higher income tax rates and/or additional top-end brackets

-

Capital gains rate increases or treatment of investment returns as ordinary income

-

Restricted tax deductions for high earners

-

Restoration of the alternative minimum tax (AMT) for corporations and modifications for individuals

What could higher taxes mean for companies and business owners?

-

Strong likelihood of decreased cash flow

-

Diminished capital for growth initiatives

-

Depressed valuations

-

Lower net take home pay

-

Reduced net proceeds on third-party sales (due to lower valuations & increased taxation)

-

Paralysis for owners seeking an exit and prolonged, holding out while waiting for better conditions

Owners seeking immediate exits may still bite the bullet and turn to third-party sales (if opportunities arise). A client once told me, “It is not what you sell for, it is what you keep.” That sentiment certainly resonates today as economic futures are uncertain and a heavy portfolio concentration in one’s own business can be risky. But there's at least one alternative.

In a high tax environment, ESOPs take on greater desirability.

An already powerful liquidity tool, employee stock ownership plan transactions can create tax benefits for all stakeholders.

-

Owners can defer and potentially eliminate capital gains taxes on the sale proceeds, as part of a 1042 rollover strategy

-

Companies can deduct the transaction amount from their corporate income taxes, and can become income tax-free entities (federal and state) in the event of a 100% ESOP sale

-

Employees gain a tax-deferred retirement benefit (allocated company stock, held in trust)

Even a 30% sale of shareholder equity to an ESOP trust (representing at least 10 employees) can yield these tax benefits. That’s especially useful for business owners seeking liquidity and diversification but who'd prefer to maintain a majority stake in their companies. Yet even in the event of a 100% ESOP sale, those owners can maintain potential upside (in the form of warrants) and play a leading role in the business moving forward. Furthermore, they retain the flexibility to sell to a third-party, down the road.

Higher taxes, coupled with a turbulent economic outlook, can limit a business’s opportunities to enhance cash flow. Stable, profitable, middle market companies may find that ESOP transactions represent an increasingly attractive path forward.