May 19, 2021

Steve Berman

High payroll companies – such as staffing, hospitality, and professional services firms – are uniquely positioned to maximize the advantages of an employee stock ownership plan.

Corporate ESOP Tax Deductions

One of the most meaningful advantages of an employee-owned company is the ability to reduce or eliminate its annual tax burden. 100% employee-owned S corporations are exempt from federal and state income taxes (except for a few states).

ESOP-owned C corporations are also entitled to unique tax incentives. These deductions are equivalent to the total price of equity sold to the employee trust. For example, if 30% of a business is sold for $20MM in an ESOP transaction, that company is entitled to $20MM in income tax deductions, spread out over multiple years. When a plan sponsor makes annual contributions to its employee trust, it is eligible for these tax deductions.

Unlocking the ESOP Sale Price Deduction

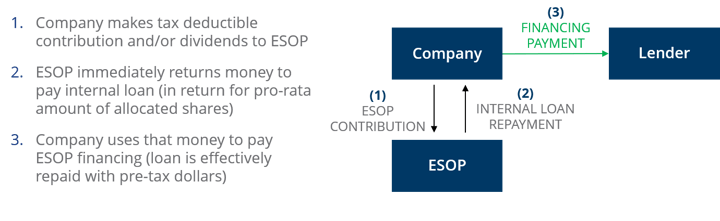

An employee-owned company is permitted to make an annual contribution to its ESOP trust, equivalent to 25% of its eligible payroll. The trust uses this contribution to repay an internal loan, created by the plan sponsor, to facilitate the original leveraged transaction (see below).

The sponsor is entitled to an annual income tax deduction equivalent to the contribution amount. If the company’s annual payroll is $10MM, it could make an annual ESOP contribution of up to $2.5MM and receive an equivalent income tax deduction.

High Payrolls, Accelerated Tax Deduction Accruals

Most staffing and professional services companies – including consulting firms, accountants, engineers, and architects – have high payroll-to-income ratios. Thus, they can typically make larger contributions, relative to ESOPs from other industries. In doing so, these firms can access their pool of sale price deductions more quickly and substantially reduce their taxable income in the years immediately following their ESOP sale.

The company can use the incremental cash flow from these tax savings for working capital, debt reduction, acquisitions, growth, or to increase cash reserves. Once the tax benefit is exhausted, employee-owned C corps seeking to extend their ESOP tax advantages may opt to:

- Sell an additional equity stake to the ESOP and secure new sale price deductions;

- Convert to an S corp, when permissible, and secure ESOP tax advantages in perpetuity (any earnings attributable to ESOP-owned equity in an S corp are shielded from federal and most state income taxes).

Overcoming Cash-Based Accounting Liabilities

There’s another tax wrinkle that makes ESOPs particularly advantageous to staffing and professional services companies. While most of these firms prepare financial statements under generally accepted accounting principles (GAAP), many report taxes on a cash basis. Taxes are paid only on cash receipts as receivables are collected. Substantial variances between accrued taxable revenue and accounts receivable are common.

This cash vs. accrual variance is an embedded tax liability – one that is often overlooked until a corporate sale takes place. Before a transaction (including an ESOP sale), a cash basis acquisition target will be required to adopt the accrual accounting method. That change may result in substantial revenue recognition (and income).

In the event of a third-party or private equity transaction, this tax liability can erode sale value. An employee stock ownership plan transaction is subject to the same taxes, but the previously discussed ESOP tax deductions can reduce or eliminate a cash-to-accrual liability. That buffer can make a significant difference in terms of sale proceeds.

Consult Your Advisors

Of course, the ESOP tax implications referenced here are nuanced. An employee ownership sale is a multifaceted transaction with unique costs and benefits. It should not be viewed as a foolproof path to tax deductions. Instead, a leveraged ESOP transaction, or a secondary sale, merits careful planning with relevant tax, accounting, and financial advisors.

But, when an employee stock ownership plan makes sense for all relevant stakeholders, it can drive meaningful benefits for already high-performing companies – especially those in the staffing and professional services industries.