.png?height=400&name=Spring%202024%20(2).png)

April 26, 2024

CSG Partners Staff

The wait for fresh federal ESOP data begs patience. There's often a two-year lag. But once the 2021 dataset dropped, CSG's team crunched the numbers and uncovered some notable trends. Axios took notice and offered a great summary.

The Wall Street Journal and the How 2 Exit podcast also turned to CSG's experts for timely employee ownership-related commentary.

Axios Features Andrew Nikolai

The Surging Wealth of Employee Owners

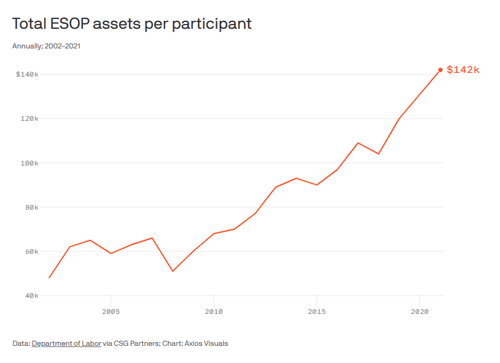

Leveraged ESOPs, are more popular than ever, says Andrew Nikolai of CSG Partners, an ESOP advisory firm. The buyers — the employees — don't have to put up the cash for the deal; instead, the purchase is financed, and they build up their equity over, typically, 20 years. As of end-2021, the most recent year for which we have data, there were 3,445 leveraged ESOPs, with an average of $166,000 in assets per participant. That number — a large part of the wealth of ESOP employees — rose 44% just between 2018 and 2021.

As of end-2021, the most recent year for which we have data, there were 3,445 leveraged ESOPs, with an average of $166,000 in assets per participant. That number — a large part of the wealth of ESOP employees — rose 44% just between 2018 and 2021.

While leveraged ESOPs account for most new ESOPs, it's the more established unleveraged ESOPs that account for the lion's share of total assets. Their $1.8 trillion in assets works out to $139,000 per participant.

The bottom line: ESOPs, like unions, have proven to be a very effective wealth-creation mechanism for Americans without college degrees.

The complete article is available on Axios.

The Wall Street Journal Quotes Lawrence Kaplan

Room & Board Sets Up Employee Stock Ownership Plan, Giving Workers a Stake

"The kind of companies that make good ESOP candidates have got positive cash flow," said Lawrence Kaplan, managing partner at CSG Partners, an ESOP-focused investment bank that wasn’t involved in the deal. "They’re usually family-owned businesses in which the owner probably wants to take some chips off the table and wants to leave a legacy for their community."

Congress passed a law in 1974 creating tax incentives for employees to become shareholders as part of an ESOP. Companies such as grocery chain Publix Super Markets, women’s clothing brand Eileen Fisher and Gore-Tex maker W.L. Gore & Associates use these plans. Accounting firms BDO USA and Grassi adopted ESOPs last year in a bid to recruit and retain workers amid a growing shortage of auditors in the profession.

The complete article is available on The Wall Street Journal.

How2Exit Podcast Interviews Michael Bannon

Unlocking Business Exits with ESOPs

"A lot of founders view their business as their baby and that means they've raised it from square one. They've cultivated the team within the business, and they've tried to prepare it for whatever the future may bring."

"If you're happy with that team, you would assume they are the people that you trust most to continue managing that business. An ESOP gives you an opportunity to hand the reigns of leadership over to that management team, or to all of the employees within your organization. So, there's a really big legacy component or succession component."

"There's also a lot of flexibility with ESOP because we're not going out and putting your company on the market for other bidders to come in with their own structures and their own way to set up the transaction. We have much more flexibility and much greater ability to tailor the transaction to the company's key stakeholders, as opposed to most transactions which are really structured by the buyer for the buyer on a post-transaction basis."

Michael Bannon's complete interview is available on How2Exit.